Open loans & accounts like a Fintech. Without becoming one

The AI-native Loan Origination System & Account Opening delivering Proactive automation, Guaranteed.

All-in-one

Fintech-like mobile experience. Channel-hopping. Fully Configurable.

Configure it to meet your workflow and achieve 0 training.

>200 integrations. Build your own or we build them in <1month, guaranteed.

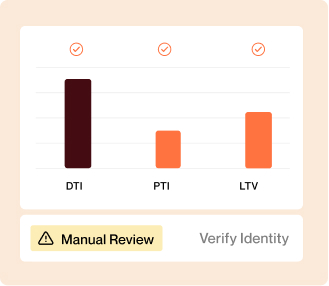

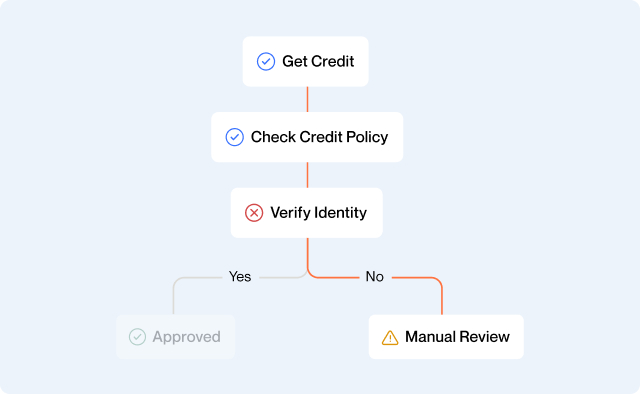

AI automation, AI Doc reading, AI Fraud verification, AI communications.

Merchant Portal

Multi-offers, Doc generation, doc validation.

No-code config with the ability to automate anything, guaranteed.

Pre-made & custom reports accessing all data from the system.

Pre-made & custom reports accessing all data from the system.

Proactive and Guaranteed

The only system with automated solutions that ensure results

Proactive Automation

Meet bi-weekly with our Automation Coaches

Review & implement AI-powered automation recommendations.

Customers automate on average >1% a week, 71% a year.

Guaranteed Automation

We write our promises into the contract, not the sales deck

Fuse assumes the implementation and execution risk.

If results don’t materialize, we don’t get paid. It’s that simple.

Join 100+ FIs getting tangible results

conversion

2.4x

just 1 year

71%

68%

3.1x

The new leader in Lending & Account Originations

Used by 100+ Leading FIs

Including Credit Unions, Banks, and Non-bank lenders.

Raised $25M+ from the investors of Chime and OpenAI

To help FIs compete with Fintechs.

Enterprise-Grade Infrastructure

SOC 2 security and Single-tenant environment tailored for secure financial organizations